Mushoka is the name of a government subsidy that began in October of 2019. The subsidy was created to incentivize both parents to work, thus increasing GDP. In addition, it is hoped that it will encourage the childbirth rate to increase by relieving the burden of childcare costs.

The amount of subsidy the student may receive is dependent on what type of childcare facility they use. Also, the needs of the parent are taken into consideration. The national government pays ½ of the subsidy, the prefecture pays ¼ of the subsidy, and the local municipality pays ¼ of the subsidy. Each municipality has its own rules about when and how paperwork for the subsidy is handled. In general, a parent will go to the municipality office and file paperwork to receive mushoka. The paperwork will then be sent to the childcare facility or the student will take the paperwork to the childcare facility. The childcare facility completes the initial sign-up paperwork and the student is then enrolled. Then, in general, the childcare facility will complete paperwork for each month the student attends, then give the paperwork back to the student each quarter. The student then presents the paperwork to their municipality to receive the subsidy. Some municipalities may request to receive the paperwork from the childcare facility directly. In general, the subsidy is paid in a lump sum each quarter, the month after the quarter ends. Mushoka does not cover expenses, such as lunch, events, bus costs, etc. However, some municipalities have elected to pay for additional costs, such as lunch. Due to municipalities paying different subsidies, it is possible for students attending the same childcare facility, but living in different municipalities, to receive different subsidy amounts.

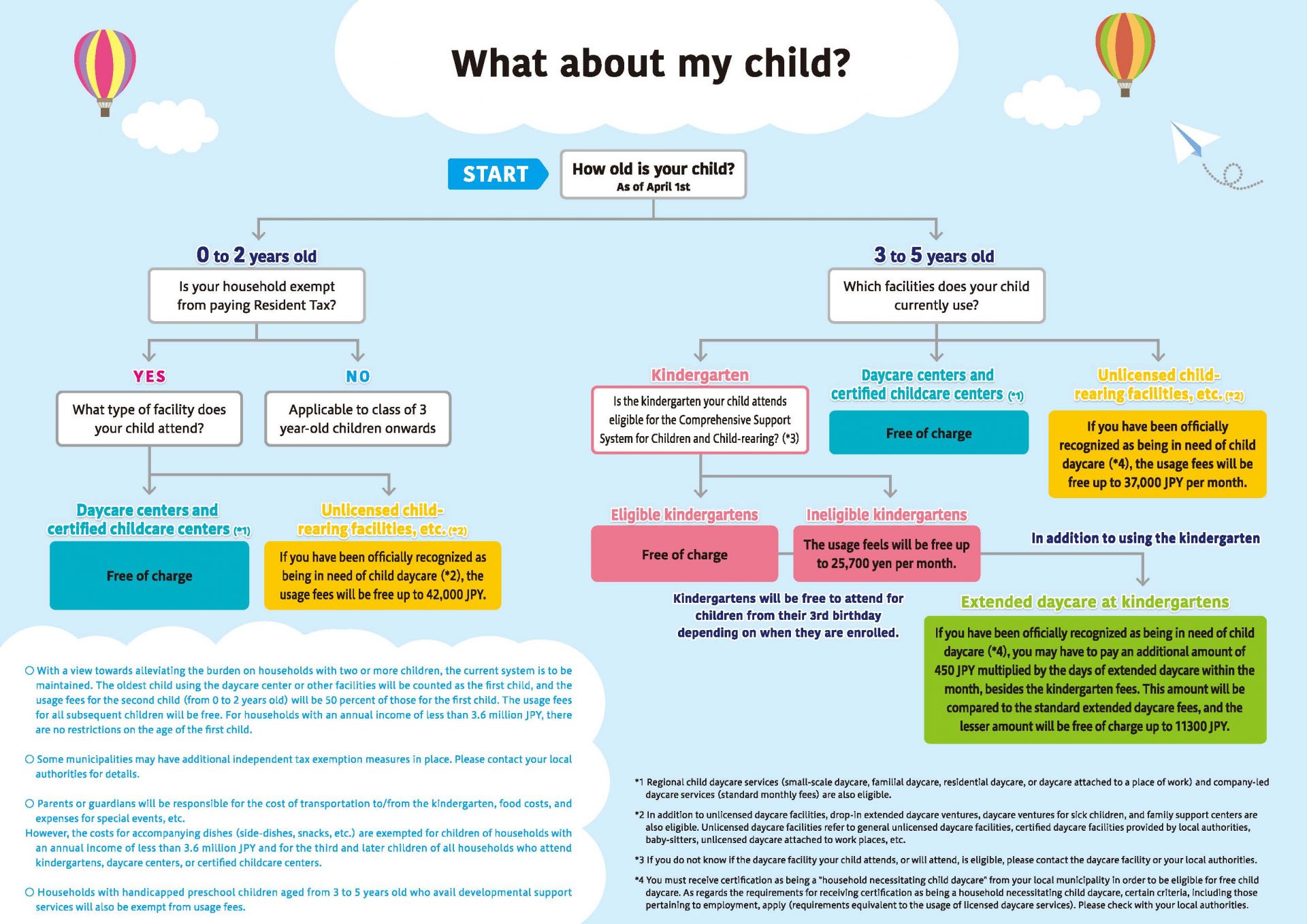

For a Ninkagai-Hoikuen, the students 3 to 6 years old may receive ¥37,000/month, if a municipal office agrees that a child needs daycare due to parents' jobs, sickness, or any other reasons. In general, each parent needs to work a minimum of 60 hours a month to be eligible. For children aged 0 to 2 years old, if the household is qualified as residential tax-exempt AND has the municipal office's approval of necessity of daycare use, then they are eligible for monthly subsidies up to ¥42,000.

If a childcare facility’s monthly tuition is less than the subsidy maximum, then the student is only reimbursed for the amount paid. For example, if a childcare facility charges ¥30,000/month, then the student will only receive ¥30,000/month, and NOT ¥37,000/month.

Please see the English information below that was created and provided by the Japanese national government. It provides a flowchart for determining whether a child is eligible for the Mushoka subsidy. The final image, in Japanese, is the Mushoka introduction poster that was distributed to childcare facilities.